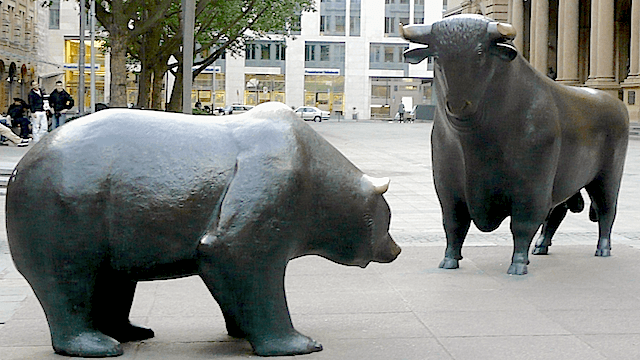

Gold: bullish or bearish? This is the big question being discussed by big names in the investment business.

Bullish or bearish? Gold on the rebound

According to billionaire hedge fund manager Paul Singer, gold’s best quarter in the past 30 years is just on the horizon, especially has global investors “weigh the ramifications of unprecedented monetary easing on inflation,” in a recent Bloomberg article.

“It makes a great deal of sense to own gold. Other investors may finally by starting to agree,” writes Singer in a letter to clients on April 28th. “Investors have increasingly started processing the fact that the world’s central bankers are completely focused on debasing their currencies.”

During the first three months of this year, gold for immediate delivery grew 16%, the largest quarterly surge since 1986—all while the Federal Reserve refrained from tightening and negative interest rates continue in European and Japanese central banks.

Billionaire investor Stan Druckenmiller agrees. With one of the best long-term records in money management, Druckenmiller says, “gold is his largest currency allocation and the bull market in stocks was exhausted.”

And you can also add BNP Paribas SA to list of gold devotees. With a 2013 prediction that gold may be “rediscovered” by investors who need to own something “real”, they predicted in April 2016 that gold may advance to as high as $1,400 in the next 12 months. This is especially in response to investor concern over the effectiveness of central banks’ to sustain growth.

Bullish or bearish? “Not so fast,” says Goldman Sachs…

New York giant Goldman Sachs Group Inc. isn’t so convinced about the future of gold, and maintains a bearish outlook. Despite increasing its bullion predictions to $1,200 an ounce in three months, $1,180 in six and $1,150 in a year from $1,100, $1,050 and $1,000 in their new forecast, they still expect weaker gold prices of the next year.

According to analysts, “while the upside risks to gold pricing appear relatively limited from here, we see a number of catalysts for gold prices to moderate, including a more hawkish Fed and ultimately U.S. policy rate divergence, corresponding with gradual dollar appreciation over the next 3-12 months.“

Goldman Sachs analysts’ also indicate the China’s stability will play a big role in the future of gold prices:

“The risk-off environment which contributed to gold’s outperformance at the beginning of this year is less likely to repeat in the near future as confidence in Chinese growth, Chinese currency stability, and the potential for a collapse in oil prices is much reduced.”

Societe Generale SA and Morgan Stanley share this bearish outlook. In March, the Societe Generale SA said that gold’s rally was unsustainable, with forecasts that the prices will average $1,075 in the fourth quarter. And while Morgan Stanley increased their forecast for gold, the average outlook for the third quarter is $1,150, still lower than current prices.